In fact, median rent prices in Honolulu rose by 20.1 percent between 20, while incomes rose by just half that amount. That’s not going to be true for your rent. The good news: The monthly mortgage payment on a fixed loan won’t change for 30 years. Buy Calculator on our site, and run the numbers yourself! Down paymentįor a more precise estimate, using your own numbers, try our Rent vs. How much can you borrow? Here are some rough numbers, again assuming today’s average 4.88 percent interest rate, and subtracting a very approximate $130 for PMI and $250 for taxes and insurance. The property taxes can vary somewhat depending on whether you qualify for additional property tax exemptions based on age, income, disability or other factors, but given an assessed value of $300,000, these figures are a good estimate. In Maui County, you will probably pay $519 per year ($43.25/month) in property taxes on a $300,000 home and on the Big Island, $816 per year ($68/month).

On Oahu, your tax rate will be $3.50 per $1,000 of “net taxable value,” or about $873 per year ($72.75/month) on a $300,000 home. Home ownership also means property taxes, which vary quite a bit by island. And if you are putting less than 20% down, you’ll also need to pay private mortgage insurance (PMI). As a homeowner, you’ll also need to take into account homeowners, flood, and windstorm insurance, which will likely run $100-200 per month. The amounts above are a stripped-down estimate. The minimum down payment to avoid having to pay private mortgage insurance is 20 percent.Conventional mortgages generally require a minimum down payment of 10 percent.FHA loans generally require a 3.5 percent down payment.Veterans qualifying for a VA home loan can buy with no down payment.We chose the down payment amounts shown because those are important thresholds in the mortgage world: So using that as our basis for calculation, here’s what $2,000.00 per month will buy: Down payment

#AVERAGE MONTHLY MORTGAGE IN HAWAII MAC#

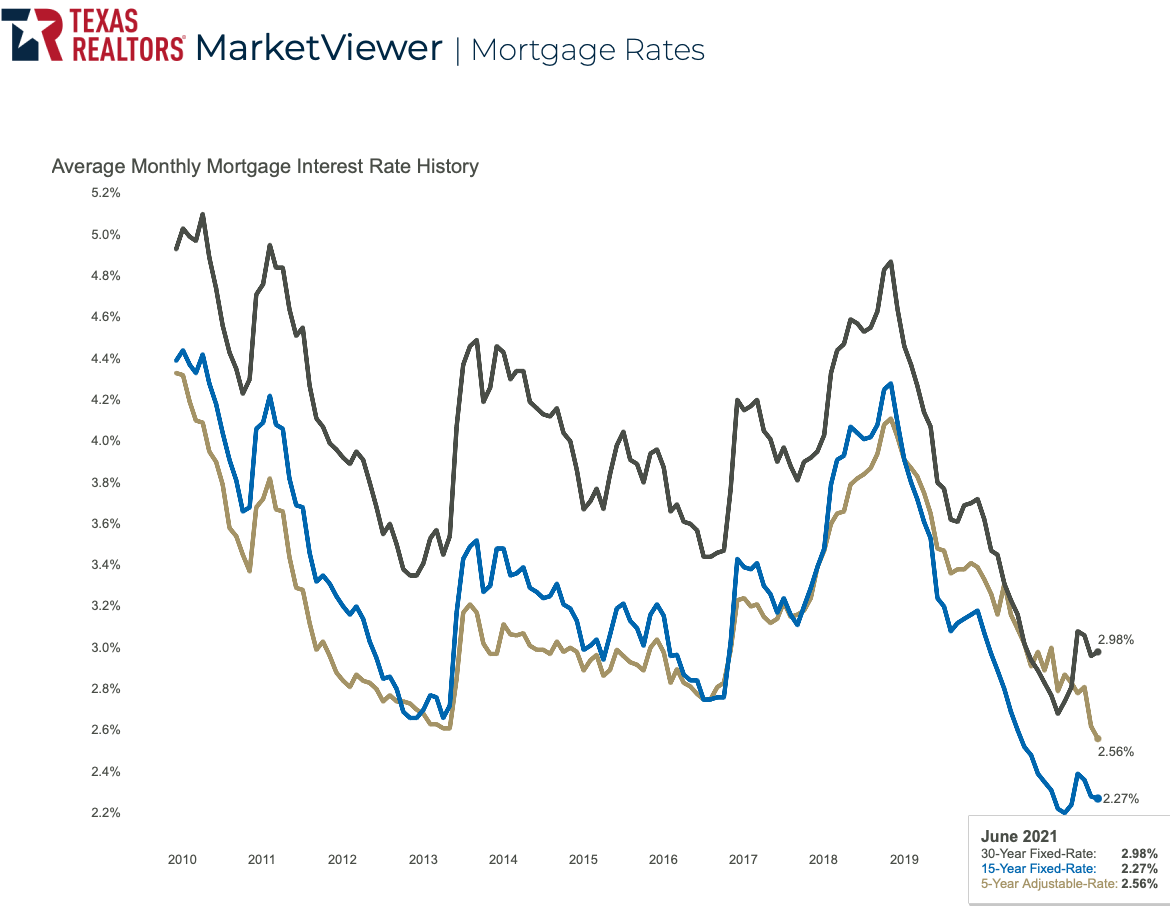

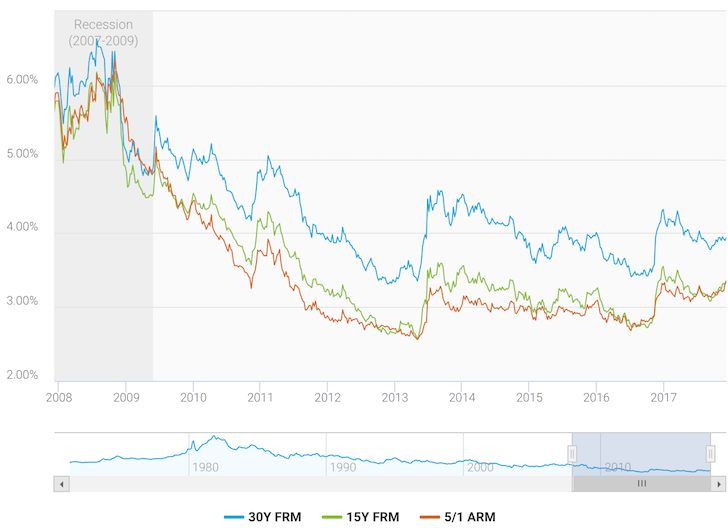

A year ago, it averaged 4.83%, Freddie Mac said.If you’re getting tired of making your landlord wealthy instead of yourself, you might be wondering how much house you can buy for that money.Īccording to, today’s average mortgage rate is 4.88 percent. The average rate on 15-year fixed-rate mortgages, popular with those refinancing their homes, also rose this week, increasing to 6.06% from 6.03% last week. That open-ended approach has heightened uncertainty about the Fed’s next moves, which could lead to more volatile moves for mortgage rates.

Still, the Fed warned that it could raise interest rates two more times this year in its battle against inflation. The central bank opted to forgo another increase at its meeting of policymakers earlier this month. Treasurys, which lenders use as a guide to pricing loans, investors’ expectations for future inflation and what the Fed does with interest rates influence rates on home loans.Īll told, the Fed raised its benchmark rate 10 times, starting in March 2022. That trend began to reverse a little over a year ago, when the Federal Reserve began to hike its key short-term rate in a bid to slow the economy to lower inflation. Low mortgage rates helped fuel the housing market for much of the past decade, easing the way for borrowers to finance ever-higher home prices. homes were down 20.4% from as year earlier, marking 10 consecutive months of annual declines of 20% or more, according to the National Association of Realtors. Last month, sales of previously occupied U.S. The dearth of properties on the market is also a key reason home sales have been slow this year. The far higher rates now are contributing to the low level of available homes by discouraging homeowners who locked in those lower borrowing costs two years ago from selling. The average rate on a 30-year home loan is still more than double what it was two years ago, when the ultra-low rates spurred a wave of home sales and refinancing. The median monthly payment listed on applications for home purchase loans in May rose to $2,165, up 14.1% from a year ago and a 2.5% increase from April, the Mortgage Bankers Association said today.

High rates can add hundreds of dollars a month in costs for borrowers, limiting how much they can afford in a market that remains unaffordable to many Americans after years of soaring home prices and limited housing inventory. On June 1, it averaged 6.79%, its highest level so far this year. The increase brings the average rate back to where it was three weeks ago. Mortgage buyer Freddie Mac said today that the average rate on the benchmark 30-year home loan rose to 6.71% from 6.67% last week. mortgage rate rose this week, snapping a three-week pullback after reaching a high for the year in early June.

0 kommentar(er)

0 kommentar(er)